What is short selling?

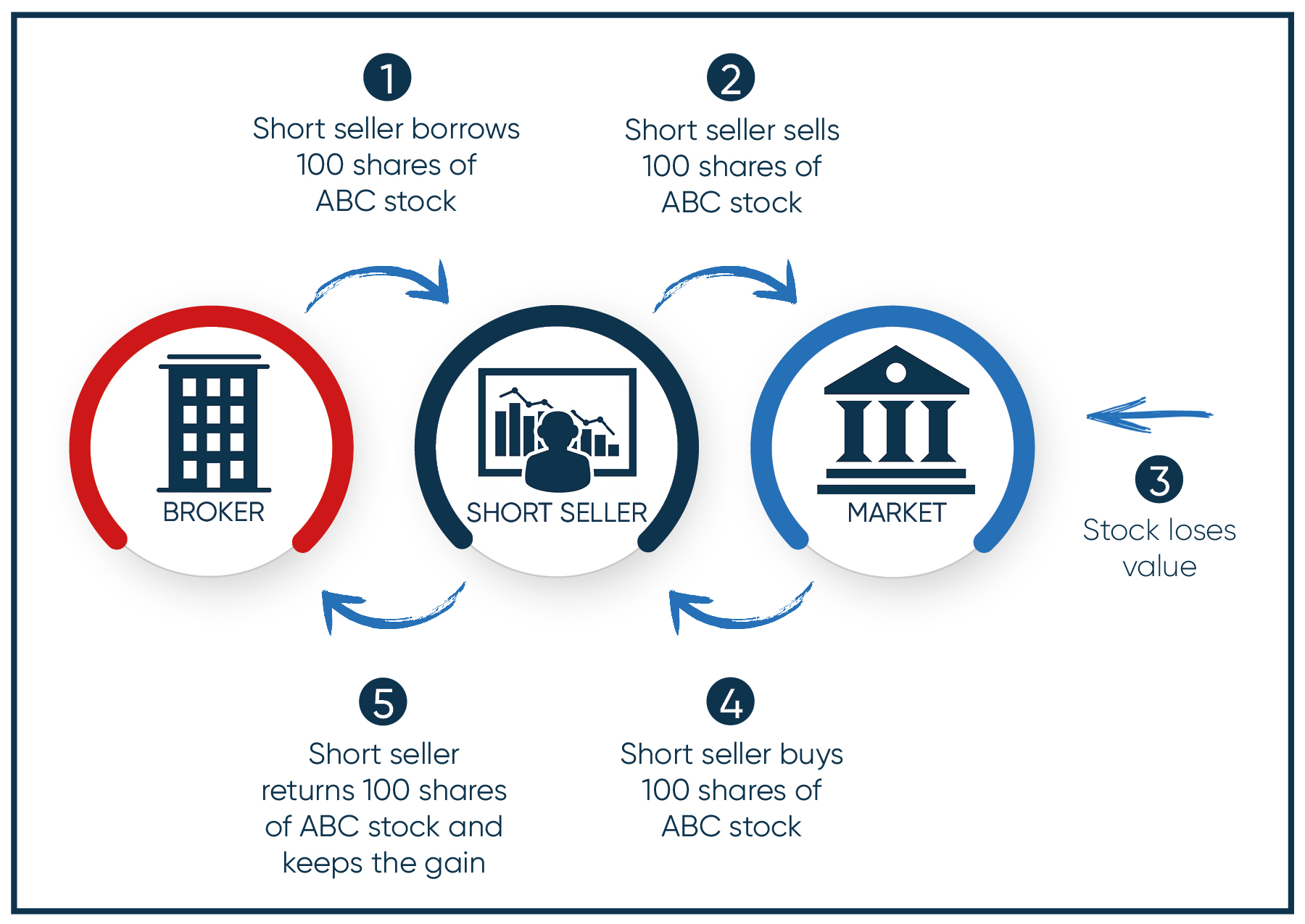

Short selling, also known as shorting stock, involves the sale of stocks that the seller doesn’t own. These shares are borrowed from a broker then sold short on the market in the hope that the short seller can buy back the shares at a lower price and return the shares to the broker.

Short selling is like borrowing on margin, except instead of borrowing funds to purchase shares the investor borrows shares to sell them. In both cases, the investor is using leverage.

The investor, hence, the seller, will profit from the difference between the higher price the shares were sold at and the lower price they were bought back at.

Why and when to short a stock?

Investors who short stocks do so because they believe a stock is overvalued and that the price will decline.

The outlook on the stock could be bearish in the short term but still have a bullish view over the long term, or the outlook can be bearish for both periods.

In either case, the short seller is willing to speculate that, by selling the shares now, they will be able to buy them back at a lower price and keep the difference as profit. When looking at individual stocks, there are many factors that can cause a stock to decline. Unfortunately, deciding when one should short a stock and for how long is not an exact science.

Short selling may only make sense in certain situations, such as in a bearish market or if a company is experiencing financial difficulties.

How to determine if a stock is bearish?

Some investors use technical analysis events to help determine if a stock, sector, or market is currently bearish or potentially heading in that direction. There are several different events that can be used individually or in combination to determine if a security is bearish, neutral, or bullish. Here we have some examples:

- Trend

- Price level (Support and Resistance)

- Moving averages

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

Other investors will choose stocks for short selling based on poor financial performance or the expectation of it. Whether a stock is considered growth, value or something in between by investors, being able to meet or exceed their financial expectations is important, otherwise the share price could decline. A company with high debt levels and struggling with servicing that debt, could also be of concern and cause the stock price to decline.

Companies with profits or sales that are declining or inconsistent can have volatile share prices, making them interesting candidates for short selling.

How to short a stock?

An investor believes that the shares of ABC company, which are trading at $80, are overvalued and that the share price will decline. The investor places a sell order for 200 shares of ABC in the short selling account and the shares are sold at $80, proceeds received of $16,000. After a few days the share price falls, and ABC is now trading at $60.

The investor now buys 200 shares for $60 of ABC company, which costs $60 X 200 = $12,000 to cover the short position in the short selling account. The net profit for the short seller assuming there is no borrowing fee is $16,000 - $12,000 = $4,000

What is my maximum profit when short selling?

The potential profit when shorting a stock is maximized when the share price drops to zero, in our example the maximum profit would be $16,000.

What is my maximum loss in a short sell?

When short selling, the investor needs to be aware that losses can be unlimited because the share price of the shorted stock can continue to increase.

What account do I need in order to short sell?

An investor will need to have a margin account and a short-selling margin account because collateral is required in case the share price of the stock sold increases.

Looking for bearish stocks? Discover how Technical Insight can help you find them.

How to protect yourself when short selling?

Shorting stocks comes with risks that can cause large losses for the short seller, if the share price increases. What can a short seller do to protect themselves?

Most investors are familiar with stop loss limit orders. In short selling, you can place a stop buy limit order to protect yourself in case the stock price increases. A buy-stop order is the opposite of a stop loss order, it can help protect a gain or limit a loss for the short seller.

The main difference is that a stop buy limit order would be placed in the margin short selling account to buy back the stock in case the share price increases, the price would be set above the current market price. The order would only be triggered if the price rises above the buy stop price or trigger price.

Understanding key terms when short selling

There are certain terms associated with short selling that investors need to be familiar with:

- Borrowing Fee, also known as the lending fee, is a fee that the short seller will pay for borrowing the securities. This fee will vary (ex: 0.25% to 20% or more) depending on market factors such as the supply and demand for the security.

- Mark to Market: When a stock is shorted, the proceeds of the sale remain in the short selling account as collateral. If the price of the stock increases, the short seller will have cash transferred from the margin account into the short selling account to reflect the cost of buying back those shares. If the share price declines, the opposite would occur. This movement of funds is known as mark to market.

- Short squeeze a short squeeze occurs when a heavily shorted stock’s share price begins to increase rapidly. As the share price continues to increase, short sellers begin to buy shares to cover their short position which further increases the share price. Depending on how quickly this happens, a short seller can end up having significant losses.

Pros and Cons of short selling

For investors looking to apply a short selling strategy in their portfolio, there are several points that need to be taken into consideration to fully appreciate the potential risks and rewards.

Advantages of short selling:

- Being able to earn money in fallings markets, if successful.

- Using leverage (less of your own money) to make a potential profit, with the margin account.

- Possibility of making high profits in a short period of time.

Disadvantages of shorting stocks:

- Possibility of unlimited losses if the shorted stock price increases.

- The potential profits are limited because stocks can’t fall below zero.

- The broker can call back the borrowed shares at any time.

- Rapid share price increase caused by a short squeeze.

- Need a margin account, if the shorted stock price increases you could face a margin call.

- Could end up paying margin interest.

- For hard to borrow shares, the borrowing fees can be expensive.

- If the shorted stock pays a dividend, the investor is responsible for making that payment.

Is short-selling good for the financial markets?

Aside from the disadvantages listed above many investors question whether they should even consider shorting stocks because they perceive it as a form of market manipulation. There are certain benefits that short selling may provide to the financial markets:

- Increased liquidity for shares, more volume, and tighter bid/ask spreads.

- Helps better reflect the actual share price, because both good and bad news can quickly be reflected in the share price.

- Improves corporate governance, since short sellers are motivated to find financial shenanigans, it encourages management to provide full disclosure of information and not hide their errors.

Short selling and securities lending

Short selling is also part of a larger business called securities lending that has been around for over 40 years. It has historically been the domain of institutional investors. How does it work? A borrowing fee is paid when the shares are loaned which is an additional source of income for their portfolios.

Short selling as an addition to your portfolio

Did you know that securities lending is now offered to NBDB clients, and they can potentially earn additional income in their non-registered accounts with our very own Fully-paid securities lending program? Learn more

The one undeniable fact about the stock market is that it will fluctuate, on any given day individual stocks and ETFs will either increase or decrease. For investors that have the knowledge, risk appetite and financial means, a short selling account could be an interesting addition to potentially profit from any market conditions.

Ready to start short selling?