Investing in the stock market

$0 commission on all online stock and ETF transactions

Get fully invested.

Buy and sell stocks and ETFs with $0 commission.

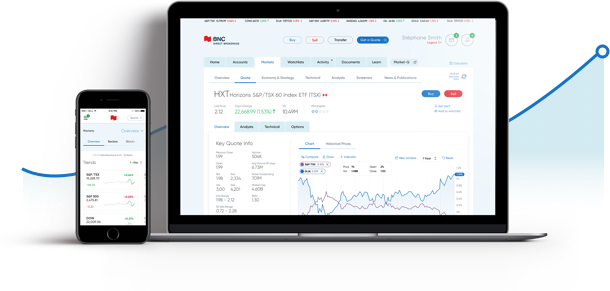

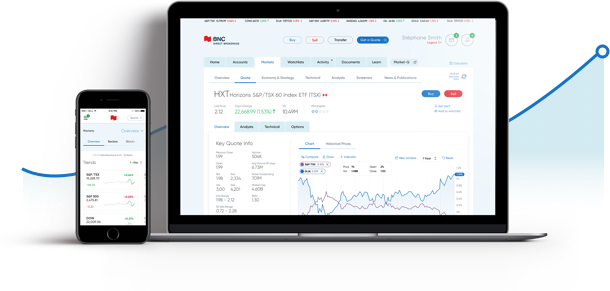

Take control of your online investments

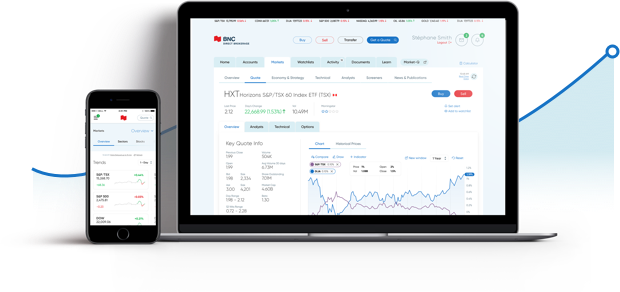

Trade your stocks, options*, and exchange-traded funds (ETFs) independently on the Canadian and US markets.

Save on transaction fees

You're not dreaming: carry out all your stock market trades for $0 commission1. No minimum required.

Make informed decisions

Our platform is designed for investors of all kinds and offers many decision-making tools (Strategy Builder, Value Analyzer, OptionsPlay and more).

- Track your investments

- Carry out transactions

- Check prices

Track your investments at a glance

The dashboard provides a quick overview of your investments:

- Real-time values

- Trades and transfers

- Unrealized gains and losses

- Alerts and important messages

Carry out transactions at your convenience

Regardless of the product you're trading, you can check:

- Complete technical and fundamental information on the product

- How your investments are doing in real time

Check prices

You'll be able to view and monitor the following:

- Stock market fluctuations

- The day's top-performing sectors

- The day's best- and worst-performing securities on each of the major markets

- Top financial news items

- Fluctuations in international exchange rates and commodity prices

- A range of graphs, financial data, analytics and filters on the securities that interest you

- The top-performing ETFs

Quickly transfer your assets

Are your assets at another institution? Are you hesitating?

We also reimburse your transfer fees up to $150 including taxes2.

What about annual fees?

The annual administration fee is $100. But you may not have to pay it if you meet any of the following conditions:

- You’re a young investor aged 30 or under

- You hold eligible assets3 totalling at least $20,000 as of May 31**

- You are enrolled in one of our offers for professionals or newcomers

- You only have an InvestCube account

**The year runs from June 1 to May 31.

Direct Brokerage, your partner in financial success

- The security of a major Canadian bank

- Access to free tools designed to help you make sound decisions

- A cutting-edge, intuitive brokerage platform

- Support from licensed securities representatives

- Events to help expand your knowledge

Buy and sell without paying commission.

Don't miss out.

Frequently Asked Questions

No. The $0 commission is applied regardless of the number of shares traded.

No. The $0 commission applies to all equity and ETF trades in the Canadian and U.S. markets.

Trades must be made through National Bank’s Direct Brokerage trading platform.

The fine print

*Options commission is $0 + $1.25/contract. A minimum fee of $6.25/trade applies. The maximum fee is $19.95 when the transaction value is less than $2,000.

†National Bank Direct Brokerage, as a division of a Canadian bank subsidiary, is the first broker in Canada to offer a commission-free online brokerage solution for Canadian and U.S. stocks.

1. Each transaction must be completed on our online trading platform.

3. Eligible assets include cash, stocks, options, exchange-traded funds, debentures, bonds and NBI Altamira CashPerformer Accounts.

Transfer $20,000 or more to a National Bank Direct Brokerage account, buy shares, options or exchange-traded funds (ETFs) within 6 months of your transfer and we'll refund up to $150 plus taxes of the transfer fees (refunded 1 week after the transaction).

For terms and conditions, call Customer service at 1‑800‑363‑3511.