InvestCube

Automatic portfolio rebalancing

It is no longer possible to apply for a new InvestCube account. Only existing accounts will remain active.

ETFs made easy

This automatic rebalancing solution allows you to easily invest in exchange-traded funds (ETFs)1. The InvestCube account is only available to those who have already subscribed.

InvestCube allows you :

- Build your ETF portfolio by choosing from 5 asset classes

- Choose among a selection of ETFs

- Benefit from your portfolio being rebalanced automatically

- Save on management fees

$10,000

Must maintain a minimum balance of $10,000

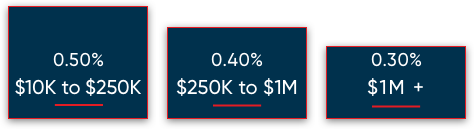

Rebalancing fee of

0.30% to 0.50%

You'll also enjoy

commission-free trading!

$0

annual administration fee

Tips from our experts

Exchange-traded funds (ETFs) are baskets of securities that are traded on a stock exchange like shares. Generally, investors use ETFs for two reasons: as a passive way to invest over the long term, or to gain exposure to a short-term trend in a given index.

Automatic rebalancing: advantages and pricing

Automatic rebalancing consists of restoring the original proportion allocated to each asset class following market fluctuations. Your portfolio therefore retains its initial diversification over the years without requiring any intervention on your part.

- InvestCube automatically rebalances your portfolio at least 2 times a year or up to 12 times if necessary

- The portfolio is rebalanced when an asset class deviates by 20% or more from its target weight.

InvestCube rebalancing fees

Rebalancing fees for InvestCube are calculated based on all the portfolios held in the same root.2

They are taxable and billed quarterly on the 22nd day of January, April, July and October. Fees are based on the average value of the portfolio on the last business day of each month.

Open an account in three steps

Contact us or sign up online

For personalized assistance, call one of our dedicated representatives at 1‑800‑363‑3511

If you prefer to sign up online, please complete this form. Print, sign and send it to us by mail or bring it to a National Bank branch.* Your account will be opened within 24 to 48 hours.

Create your portfolio

Once you open your account, you will receive an email with a link to our new selection tool where you can create your personalized portfolio. It's easy to use and no installation is required.

Activate your account

Our dedicated team will contact you by telephone to confirm your selection and complete the account opening process.

Ready to take advantage of our automatic rebalancing solution?

The fine print

The ETFs offered with InvestCube cover the broad markets and were selected according to a combination of important criteria. They feature high liquidity, low costs, good diversification, and a sizeable level of assets under management. Volatility and performance criteria were taken into account as well. Also, all the selected ETFs have at least a 3-year track record.

Passive investment strategy: An investment approach aiming to closely match the returns of an index or other benchmark. A passive investor generally takes a position that doesn’t seek to outperform a benchmark or an index, but rather exactly mirror it. A passive investor would, for example, seek to track the performance of the entire Canadian stock market.

Active Investing: An active strategy aims to adapt to fluctuating market conditions rather than perfectly reproducing a broad index. Different types of ETFs can be included in an active strategy; pure active-investing ETFs that may use a portfolio manager to choose which stocks to include in the fund portfolio or Smart-beta ETFs that may use a rules-based, systematic approach to selecting stocks.

Index: A market index is a hypothetical portfolio of investment holdings, which represents a segment of the financial market. Investors use indexes as a basis for portfolio or passive index investing. For example, the S&P/TSX Composite Index is the benchmark Canadian index, representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX) with about 250 companies included in it.

Diversification: Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. The rationale behind this technique is that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and lower the risk of any individual holding or security. Because ETFs typically try to replicate a particular index, they can provide exceptional diversification for an investor looking to gain exposure to a particular area of the market.

Fixed-income ETF: Fixed income ETFs generally seek to track underlying indices composed of individual bonds. Like equity ETFs, they trade on stock exchanges. Government and corporate bonds are the most common types of fixed-income products.

Equity ETF: Equity ETFs generally seek to track underlying indices composed of individual stocks. Like fixed-income ETFs, they trade on stock exchanges.

Alternative investments: Alternative investment solutions generally include financial assets that do not fall into one of the conventional investment categories. Conventional categories include stocks, bonds, and cash. Alternative ETFs therefore provide diversification and risk management opportunities.

Management expense ratio (MER): The Management Expense Ratio (MER) represents the combined total of the management fee, operating expenses and taxes charged to a fund during a given year, expressed as a percentage of a fund's average net assets for that year. In general, ETFs tend to have much lower MERs compared to investment funds.

Holdings: Holdings are the contents of an investment portfolio held by an individual or entity, such as an investment fund or an ETF. The number and types of holdings within a portfolio contribute to the degree of its diversification. A mix of stocks across different sectors, bonds of different maturities and other investments would suggest a well-diversified portfolio, while concentrated holdings in a handful of stocks within a single sector indicates a portfolio with very limited diversification.

Distribution yield: A distribution yield is the measurement of cash flow paid by an ETF, real estate investment trust, or another type of income-paying vehicle. Distribution yields generally provide a snapshot of income payments for investors.

Conservative: The Conservative asset mix is made up of 70% fixed income and 25% equity. The detailed proportions for each asset class for the Conservative asset mix are as follows:

| Asset class | Proportion of portfolio (without alternative investments) |

Proportion of portfolio (with alternative investments) |

|---|---|---|

| Cash | 5% | 5% |

| Fixed income | 70% | 70% |

| Canadian equity | 9.5% | 8% |

| US equity | 9.5% | 8% |

| International equity | 6% | 4% |

| Alternative investments | - | 5% |

The Alternative investments asset class is optional in all portfolios

5% cash is mandatory in all portfolios.

Moderate: The Moderate asset mix is made up of 55% fixed income and 40% equity. The detailed proportions for each asset class for the Moderate asset mix are as follows:

| Asset class | Proportion of portfolio (without alternative investments) |

Proportion of portfolio (with alternative investments) |

|---|---|---|

| Cash | 5% | 5% |

| Fixed income | 55% | 55% |

| Canadian equity | 15.5% | 14% |

| US equity | 15.5% | 14% |

| International equity | 9% | 7% |

| Alternative investments | - | 5% |

The Alternative investments asset class is optional in all portfolios

5% cash is mandatory in all portfolios.

Balanced: The Balanced asset mix is made up of 40% fixed income and 55% equity. The detailed proportions for each asset class for the Balanced asset mix are as follows:

| Asset class | Proportion of portfolio (without alternative investments) |

Proportion of portfolio (with alternative investments) |

|---|---|---|

| Cash | 5% | 5% |

| Fixed income | 40% | 40% |

| Canadian equity | 21% | 18% |

| US equity | 21% | 18% |

| International equity | 13% | 9% |

| Alternative investments | - | 10% |

The Alternative investments asset class is optional in all portfolios

5% cash is mandatory in all portfolios.

Growth: The Growth asset mix is made up of 30% fixed income and 65% equity. The detailed proportions for each asset class for the Growth asset mix are as follows:

| Asset class | Proportion of portfolio (without alternative investments) |

Proportion of portfolio (with alternative investments) |

|---|---|---|

| Cash | 5% | 5% |

| Fixed income | 30% | 30% |

| Canadian equity | 25% | 22% |

| US equity | 25% | 22% |

| International equity | 15% | 11% |

| Alternative investments | - | 10% |

The Alternative investments asset class is optional in all portfolios

5% cash is mandatory in all portfolios.

Equity: The Equity asset mix is made up of 15% fixed income and 80% equity. The detailed proportions for each asset class for the Equity asset mix are as follows:

| Asset class | Proportion of portfolio (without alternative investments) |

Proportion of portfolio (with alternative investments) |

|---|---|---|

| Cash | 5% | 5% |

| Fixed income | 15% | 15% |

| Canadian equity | 30% | 26% |

| US equity | 30% | 26% |

| International equity | 20% | 13% |

| Alternative investments | - | 15% |

The Alternative investments asset class is optional in all portfolios

5% cash is mandatory in all portfolios.

The following portfolio must be rebalanced because an asset class has deviated from its target weight by more than 20%.

| Asset class | Target weight | Weight when account is reassessed | Deviation | Required action | Weight after rebalancing |

|---|---|---|---|---|---|

| Fixed income | $55,000 (55%) | $54,000 (54%) | 5% | $54,000 (52.4%) | |

| Canadian equity | $14,000 (14%) | $17,000 (16.5%) | 18% | Sell for $1,150 (2) |

$15,850 (15.4%) |

| US equity | $14,000 (14%) | $15,000 (14.6%) | 4% | $15,000 (14.6%) | |

| International equity | $7,000 (7%) | $8,000 (7.8%) | 11% | $8,000 (7.8%) | |

| Alternative investments | $5,000 (5%) | $4,000 (3.9%) | 22% | Buy for $1,150 (1) |

$5,150 (5.0%) |

| Cash | $5,000 (5%) | $5,000 (4.8%) | 3% | $5,000 (4.8%) | |

| Portfolio total | $100,000 (100%) |

$103,000 (100%) | $103,000 (100%) |

Details of the steps:

Step 1: InvestCube determines if an asset class has sufficiently strayed from its target weight to be included in the rebalancing. Since the Alternative Investment asset class has deviated by 22%, a $1150 buy is required to restore the target weight.

Step 2: InvestCube verifies which asset class is furthest from its target weight. Since the Canadian equity asset class has deviated by 18%, a $1150 sell is required to enable the alternative investment ETF buy.

Each asset class is rebalanced regardless of deviation

| Asset class | Target weight | Weight when account is reassessed | Deviation | Required action | Weight after rebalancing |

|---|---|---|---|---|---|

| Fixed income | $55,000 (55%) | $54,000 (52.4%) | 5% | Buy for $2,650 | $56,650 (55%) |

| Canadian equity | $14,000 (14%) | $17,000 (16.5%) | 18% | Sell for $2,580 |

$14,420 (14%) |

| US equity | $14,000 (14%) | $15,000 (14.6%) | 4% | Sell for $580 | $14,420 (14%) |

| International equity | $7,000 (7%) | $8,000 (7.8%) | 11% | Sell for $790 | $7,210 (7%) |

| Alternative investments | $5,000 (5%) | $4,000 (3.9%) | 22% | Buy for $1,150 |

$5,150 (5%) |

| Cash | $5,000 (5%) | $5,000 (4.8%) | 3% | Buy for $150 | $5,150 (5%) |

| Portfolio total | $100,000 (100%) |

$103,000 (100%) | $103,000 (100%) |

Each portfolio is rebalanced:

- In March and September regardless of the portfolio’s deviation

AND

- Monthly* when an asset class deviates by 20% or more from its target weighting

OR

- More than 6% of the portfolio’s value is in cash

*Portfolios are assessed for rebalancing on the

22nd of each month (or the business day before the

23rd), and the rebalancing is done the next day.

No transaction will be executed for less than $125.

The following transactions must be carried out by phone with a Customer Service representative.

Subsequent deposits

Subsequent deposits must be $3,000 or more to be invested

immediately. If you deposit less than $3,000, the amount will remain

in cash and be considered the next time the portfolio is

rebalanced.

Change in portfolio

You can carry out one modification to your portfolio each year for free. A modification includes a change to the proportion associated to each asset class as well as a change of selected ETFs. A $45 fee will be charged for subsequent changes.

Refusal of rebalancing

A secure message will be sent to you through our transactional site

before we rebalance your InvestCube account. You can contact us by

phone within 2 business days of this message to refuse rebalancing.

Unless otherwise stated, your account will be rebalanced.

Partial sale

You can carry out two partial sales each year for free. A $45 fee will be charged for subsequent sales.The portfolio's value must exceed $10,000 after a partial sale.

RRIF account sale

If payment instructions are provided, sales in RRIF accounts will be

carried out automatically.

Sale in full

If you want to close your InvestCube account, your ETFs must be sold. Funds must be transferred to another account. Once your InvestCube account is closed, it will be impossible to open a new one.

Deactivating the rebalancing feature

You keep your ETFs, but they are no longer rebalanced

-

Management and other fees may apply to ETF

investments. Please read the prospectus before making an investment.

ETFs are not guaranteed, their values change frequently and past

performance may not be repeated

- A root is

defined as the first six (6) digits of an account number

- InvestCube account holders, transfer $20,000 or more into an account at National Bank Direct Brokerage and we will reimburse the transfer fees up to $150 plus taxes (reimbursement made one week after the transfer).

Although the information presented is based on sources we believe to be reliable and up-to-date, we cannot guarantee its accuracy. The information in this document should not be construed as investment advice.

Learn more

Events

03/18

We're here for you

Questions? All answers, no hassle

Ready to sign up for InvestCube?

Call us to have InvestCube added to your account.

Contact-us