What is a stop loss order?

A stop loss or sell stop order allows you to set up the sale of your shares automatically at a predetermined trigger price. The main purpose of stop loss orders is to potentially sell your shares to secure a gain in the event of a decrease in the share price. Of course, if the share price does not decrease to reach the trigger price, you will keep the shares until the end of the chosen period.

What is the trigger price and the limit price?

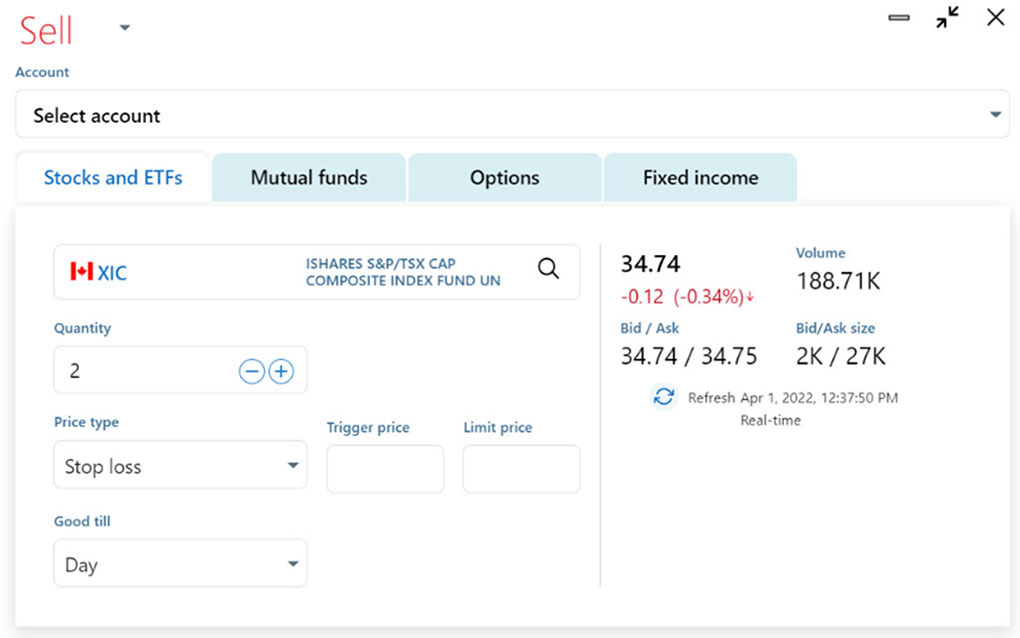

With the National Bank Direct Brokerage platform, when you enter a stop loss order, you must always indicate a trigger price and a limit price. The trigger price is the amount at which you want to sell your shares and the limit price is the minimum amount at which you agree to part with your shares.

What do you need to know about the trigger price and the limit price?

Here are some things to consider before placing a stop loss order.

1. The smaller the spread between the trigger price and the limit price, the more likely it is that the stop loss order will not be executed in the event of a sharp fall in the share value.

2. The closer the trigger price is to the share value, the greater the chances of having the sell order triggered.

As an example, let's say the share price is $35.00. To limit your loss or protect a profit, you decide to enter a stop loss order with a trigger price of $34.00 and a limit price of $33.50. Let’s continue with the example by imagining that the next morning, when the market opens, the bid price of the stock drops to $33.90. In this case, since the stock value is below the trigger price and above the limit price, the stop loss sell order will be triggered and will become a market sell order.

That said, if the share value opened at $33.00 the next day, which is below the stated price limit of $33.50, the stock would not be sold.

3. The price limit in a stop loss order must be considered as the

minimum value required to sell the security.

In other

words, below $33.50 the investor prefers to keep the share rather than

sell them.

What are the advantages of a stop loss order?

Since you aren’t always in front of your screen watching your stock prices, you may be surprised by a sudden movement in the price of one of your holdings. You may have already experienced a situation where you would have preferred to sell faster to avoid losses or to take profits. That’s why it’s important for self-directed investors to understand how to use stop loss orders.

On the one hand, a stop loss order allows you to set a selling price in the event that the share value drops below your purchase amount. You can therefore use stop loss orders to intentionally limit the maximum loss to which you are exposed. This type of order makes it easier to manage your emotions by determining in advance the price at which you will sell your shares. For some investors, this is a way to avoid significant losses by not hanging onto a stock that keeps falling.

*Source : Market-Q

In the example above, you can see that the sell stop order at $63.00 allowed the investor to significantly limit their loss during this transaction.

A stop loss order also allows you to protect some of your gains. Much like anchors for rock climbing, you can use stop loss orders to prevent your profits from dropping to zero. By setting a sale price higher than your original purchase price, you can systematically secure a portion of your gains. If the price is not reached, the shares will not be sold, and you can continue to benefit from the increase in the share price.

*Source : Market-Q

As shown in the image above, a stop loss order protects a large portion of an investor’s profits if the share price were suddenly to drop back to $67.00.

Learn how to place a stop loss order

Why use price alerts?

In addition to managing your risk with stop loss orders, you can also use alerts to stay informed of fluctuations in a stock's price. Indeed, to avoid having to constantly track price fluctuations in all the shares you own, it is possible to create alerts and receive notifications directly by email.

For example, thanks to alerts, you can enter a target price where you would be interested in selling and when the share price has reached the indicated value, you will receive a notification. Similarly, you can also be informed of a percentage change in a day or a variation over 52 weeks. Alerts always allow you to be informed of fluctuations in the price of your shares and to be able to react before it is too late.

Discover how to create an alert

How can you manage the risk of your portfolio in a calculated way?

In short, stop loss orders can be an effective tool for managing risk for investors who cannot track the price of their shares in real time. Using this type of order and creating alerts can help you limit your losses and keep control of the positions in your portfolio. In addition, stop loss orders can also reduce the emotional component of the transaction by requiring you to stay true to your initial analysis with regard to your risk-taking. In summary, it’s very much in your interest to understand stop loss orders and alerts when you trade stocks or ETFs yourself.

Log in to program alerts and stop loss orders while you’re on vacation

Author biography: Alexandre Demers has been an active investor since 2013 and is the founder and president of Traders 360 Inc. He has also authored the e-book “Investir à contre-courant” (Investing against the grain) and hosts the “Finance 360” podcast available free on Spotify and Apple Podcast. His goal is to make stock trading more democratic and educate the public at large about the possibilities of self-managed investments.

For more details, go to www.traders360.ca

The above article was written by Traders 360, an independent external firm partnered with National Bank Direct Brokerage.

Key takeaways:

- Stop loss orders allow you to automatically sell a stock if its price drops to a specific trigger point, helping you manage risk while away.

- Each stop loss order includes a trigger price (activates the order) and a limit price (minimum price you're willing to accept).

- If the stock price falls below the trigger but stays above the limit, the order is executed; if it drops below the limit, the order may not go through.

- A narrow gap between trigger and limit prices increases the risk of the order not being filled during sharp price drops.

- Setting the trigger price close to the current stock price improves the chances of the order being activated.

- This strategy helps you protect gains or limit losses without needing to monitor your portfolio constantly during your vacation.