What is an ETF? What types of ETFs are available on the stock market? All the answers on the basics of ETFs are in this article. All the answers on the basics of ETFs are in this article.

1. Can ETFs outperform stocks and funds?

One of the most common misconceptions about ETFs is that they are purely passive and cannot outperform actively managed funds or stocks. While it is true that many ETFs track market indexes and have lower fees than actively managed funds, some ETFs are actively managed and can deliver meaningful outperformance.

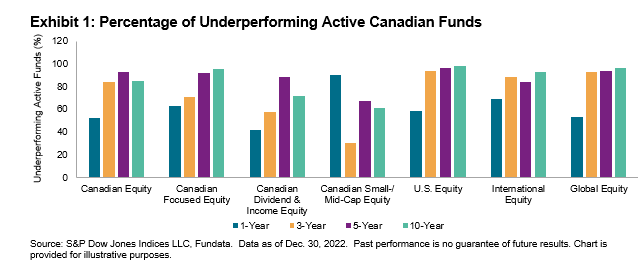

The challenge is to do so consistently over time. Studies by SPIVA (S&P Index versus Active) have shown that the majority of active managers underperform their benchmark over both short and longer-term time periods.

ETFs vs stocks

ETFs are not like stocks. ETFs trade on an exchange like a stock, but stocks have a finite number of shares available. An ETF is an open-ended fund that can create new units based on demand. Market makers will continually offer new shares and will create new units when needed.

Just like a stock, an ETF is subject to the integrity of the markets. If there is a market event or large moves in investor sentiment, we should expect ETFs to move with the market. ETFs are priced based on their underlying portfolios, not the other way around, the assumption that ETFs impacted market stability as they became prominent then doesn’t make sense.

ETFs vs mutual funds

ETFs and mutual funds (also known as investment funds) both offer investors access to a variety of securities. One of the main differences between ETFs and mutual funds is that ETFs are traded on stock exchanges and can be bought and sold like individual stocks throughout the day, while mutual funds are traded only once a day after the market closes.

Another key difference is the fees. ETFs typically have lower fees than mutual funds, as they do not require the same level of active management. ETFs also offer greater flexibility, as investors can buy and sell shares at any time during the trading day. Mutual funds, on the other hand, are generally actively managed by a professional fund manager who selects securities to buy and sell in order to achieve the fund's investment objectives.

ETFs vs index funds

ETFs and index funds have a great deal of overlap, many ETFs are in fact index funds, but while many ETFs track an index, they can also be actively managed. ETFs that track an index are called “index ETFs” or, alternatively, “index funds.” As the name implies, an index fund tracks a set index, for example the S&P 500. Investing in an index fund means your investment should track the performance of that index.

Generally speaking, active ETFs will have a higher cost than index ETFs. Both active ETFs and index ETFs (Funds) can be suitable investment options for investors seeking diversified, low-cost exposure to a particular market segment or index.

How to compare ETFs?

When comparing ETFs, it is essential to look at their expense ratios, tracking error, and the liquidity of the underlying assets. Our ETF Center video can help you learn how to compare ETFs using our tools and identify ETFs that can fit into your investment strategy.

Discover the functions of our ETF Centre

2. Are ETFs risky?

ETFs, like any investment, carry a certain degree of risk. However, the level of risk can vary widely depending on the type of ETF, the underlying assets, and the investment strategy of the ETF.

Generally speaking, ETFs can be considered less risky than individual stocks, as they are designed to provide diversified exposure to a basket of securities, which can help to reduce the impact of any single security's performance on the overall value of the investment.

Leverage or derivatives ETFs can be riskier than regular ETFs

That being said, some ETFs can be riskier than others, depending on their investment focus. For example, ETFs that use leverage or derivatives, which can increase the level of risk involved.

- Magnified losses: Leveraged ETFs can magnify losses as well as gains. If the underlying assets lose value, the leveraged ETF may experience a larger decline in value, potentially resulting in significant losses for investors.

- Volatility risk: Leveraged ETFs can be more volatile than non-leveraged ETFs, as they are designed to amplify returns on a daily basis. This can make them more susceptible to short-term market movements, and they may not perform as expected over longer periods of time. There are low volatility ETFs that can mitigate risks.

- Interest rate risk: Leveraged ETFs may be exposed to interest rate risk, as they often use borrowed funds to achieve their leverage. If interest rates rise, the cost of borrowing may increase, which could negatively impact the ETF's performance.

- Liquidity risk: Some leveraged ETFs may have lower trading volume and liquidity than other ETFs, which could make it difficult for investors to buy and sell shares at fair prices.

- Tracking error: Leveraged ETFs may not always track the underlying assets they are designed to track as expected, due to factors such as market volatility and tracking error. This can result in lower returns than expected.

3. What does an ETF cost?

Investors should be aware of the fees associated with the ETF, as higher fees can erode returns over time. One of the key advantages of ETFs is their lower fees compared to mutual funds.

The cost of an ETF can vary widely, depending on the type of assets held in the fund and the expense ratio charged by the fund's management. Expense ratios for ETFs are typically lower than those of actively managed mutual funds and can range from less than 0.10% to more than 1%.

Understanding management expense ratio

MER stands for Management Expense Ratio, and it is a measure of the total cost of owning an ETF. The MER includes the management fee charged by the ETF provider, as well as other expenses related to the operation of the ETF, such as legal and accounting fees, custodial fees, and marketing expenses.

The MER is expressed as a percentage of the ETF’s net asset value (NAV), which represents the total value of the assets held by the ETF. For example, if an ETF has an MER of 0.50%, an investor would pay $50 in annual fees for every $10,000 invested in the ETF.

The MER is an important factor to consider when evaluating the cost of investing in an ETF. Generally, lower MERs are better, as they allow investors to keep more of their investment returns. However, it's important to consider the MER in the context of the ETF's investment strategy and the potential returns or income it may generate. In some cases, an ETF with a higher MER may still be a good investment if it has the potential to generate strong returns and/ or income.

Investors should also be aware that the MER is not the only cost associated with owning an ETF. Other costs, such as trading fees, bid-ask spreads, and taxes, may also impact the overall cost of owning an ETF. It's important to consider all of these costs when evaluating the potential return and risk of investing in an ETF. Investors should be reviewing the ETF Facts document which is a standardized regulatory document outlining all the costs of the ETF as some ETF providers only show the management fee on the website. Management fees are not indicative of the total overall cost of the ETF.

4. Are ETFs a good investment for income investors?

ETFs can be an excellent investment for income investors, with several types of income-producing ETFs available, including:

Dividend-paying ETFs

These ETFs invest in companies that pay regular dividends. Dividend ETFs can offer several advantages to investors. One of the main benefits is that they provide a source of regular income through dividend payments. This can be especially appealing to investors who are seeking to generate passive income from their investments.

Additionally, dividend ETFs may also provide investors with exposure to a diversified portfolio of dividend-paying stocks, which can help to reduce overall portfolio risk and provide potentially more stable returns over the long-term.

Bond ETFs

Fixed-income ETFs invest in government or corporate bonds, providing investors with regular income. They can offer several advantages to investors, particularly those who are looking for potentially lower-risk investments. One of the main benefits of bond ETFs is that they provide exposure to a diversified portfolio of bonds, which can help to reduce overall portfolio risk.

Additionally, bond ETFs can provide investors with regular income through coupon payments, which can be reinvested to generate compounded returns over time. Bond ETFs can provide investors with the ability to invest in bonds with different maturities, credit ratings, and geographic regions, allowing for a more customized and diversified investment strategy.

Covered call ETFs

Covered call ETFs can offer several advantages to investors. One of the main benefits is that they can provide a source of regular income through the premiums earned from selling call options on the underlying stocks held in the ETF's portfolio.

The options premiums are generally treated as capital gains rather than ordinary income. Capital gains are typically subject to lower tax rates than ordinary income, so investors may be able to reduce their tax liability by investing in covered call ETFs, as compared to an investment that generates an equivalent amount of interest income. This can be especially appealing to investors who are seeking to generate passive income from their investments.

Additionally, covered call ETFs may offer potential downside protection, as the premiums earned from selling call options can help to cushion losses in the event of a decline in the value of the underlying stocks. Covered call ETFs may also provide investors with exposure to a diversified portfolio of stocks, which can help to reduce overall portfolio risk.

5. Are ETFs liquid?

Some think ETFs are not liquid. ETFs have access to the liquidity of their underlying portfolios. Therefore, a large trade on a small ETF may not move the ETF’s market price. Also, ETF quotes are constantly refreshed, which works like a stock. Market Makers may have offsetting trades on ETF transactions, which neutralizes the market impact on the underlying securities.

6. ETFs can be for every investor

Whether you are an active trader, or day trader, long or short-term investor. ETFs can be an attractive investment option for many different types of investors, regardless of their investment goals, risk tolerance, or level of experience. ETFs offer investors the benefits of affordability and diversification.

Additionally, they also offer investors flexibility to trade throughout the day, allowing them to react to market changes and adjust their portfolios as needed with ease. ETFs are a great way for investors to better understand their investments offering complete transparency around holdings, disclosing on a daily basis the entire portfolio.

Overall, ETFs can be a great investment option for many different types of investors, as they provide a range of benefits that can help to meet the diverse needs and preferences of investors.

Ready to invest in ETFs?

Key takeaways:

- ETFs are open-ended funds that trade on an exchange like a stock, but can create new units based on demand. An ETF is priced based on its underlying portfolio.

- ETFs are different than mutual funds: they typically have lower fees and greater flexibility, as investors can buy and sell shares at any time during the trading day.

- ETFs provide diversified risk exposure, making them less risky than individual stocks. However, some ETFs can be riskier than others, such as those that use leverage or derivatives.

About the author

Erin Allen has been a part of the BMO ETFs team driving growth since the beginning, joining BMO Global Asset Management in 2010 and working her way through a variety of roles gaining experience in both sales and product development. For the past 5+ years, Ms. Allen has been working closely with capital markets desks, index providers, and portfolio managers to bring new ETFs to market. More recently, she is committed to helping empower investors to feel confident in their investment choices through ETF education. Ms. Allen hosts the weekly ETF Market Insights broadcast, delivering ETF education to DIY investors in a clear and concise manner. She has an honors degree from Laurier University and a CIM designation.