Investors looking to enhance their equity positions can write covered calls to generate income. Additional yield can be added by purchasing stocks at a discount with cash-secured puts. In this post we will explore which options strategies to use, how to implement them and best practices for maximizing their effectiveness. To learn more on how to enhance your equity investments with options, view our latest webinar.

Cash-Secured Puts

We will start by exploring cash-secured puts, since every equity investment begins with a stock purchase. A cash-secured put simply involves writing a put option while setting aside enough cash to buy the stock in case of assignment. By writing a cash-secured put, the option writer is obliged to buy the stock at the strike upon expiration if the stock is trading below the strike. This is primarily considered a stock acquisition strategy. Put writers receive a premium, so the strategy allows the investor to generate income while attempting to purchase the stock. Furthermore, the premium received from writing the option reduces the total cost of the stock in the event of assignment. To learn more about best practices for cash-secured puts, visit our blog post and webinar on this topic.

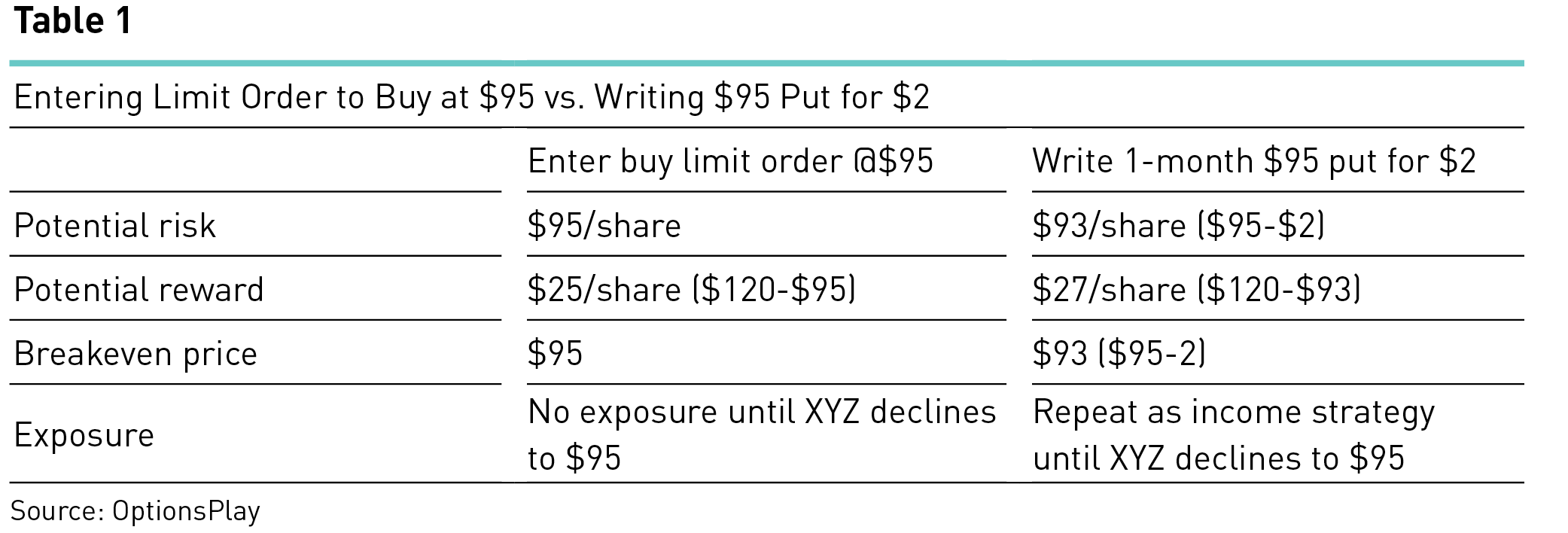

Consider the following theoretical example:

XYZ is currently

trading @ $100/share.

Goal: To purchase XYZ at $95/share, with a

target price for the stock of $120.

In the above example, XYZ stock bought through a put option is

acquired at a $2/share discount compared to entering a buy limit order.

Strategy

The ideal outlook for this strategy is when the investor has a short-term neutral or bearish view and expects a longer-term rally. If the stock stays above the strike at expiration and there is no assignment, the investor keeps the premium as income. A put writer can continue to write puts and generate an income stream on the cash that has been set aside to acquire the stock.

Covered Calls

Once a stock is acquired at a discount using cash-secured puts, a covered call can further enhance this equity position by generating an income stream while holding the asset. There are two steps required for an investor to execute this strategy – owning a minimum of 100 shares of a stock and writing a call option against it. By writing a covered call, the option writer will be obliged to sell the stock if it is trading at the strike upon expiration. To learn more about covered calls, visit our blog post and webinar on this topic.

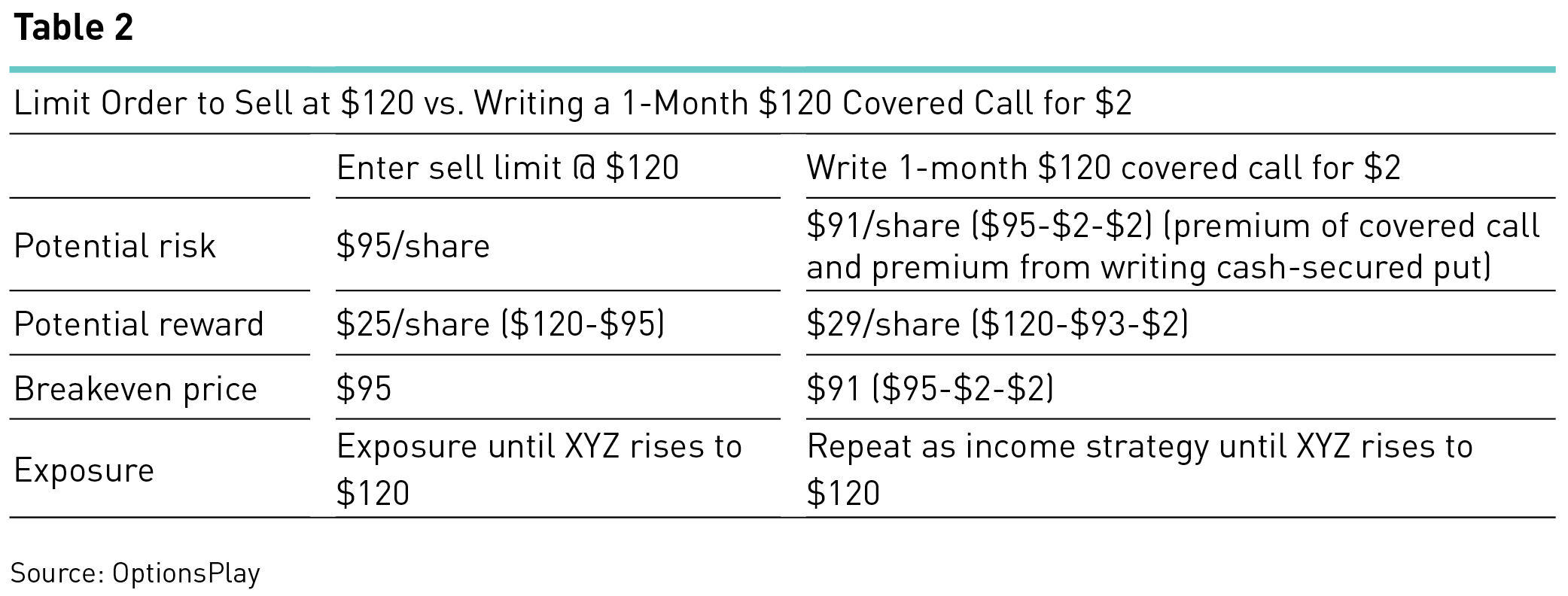

Covered calls and cash-secured puts can be combined to acquire a stock at a lower price and create an income stream while waiting to sell the stock at a higher price. Consider the following example:

The investor acquires 100 shares of stock XYZ @ $93 by writing a $95 put for $2.

The investor has a target price for the stock of $120.

Limitations

Combining both strategies is one way for investors to buy low (through cash-secured puts) and sell high (with covered calls). It also generates an income stream for downside protection while the investor waits for both the stock acquisition and sale trades to be executed. However, there are limitations to this strategy:

- Patience is required, as options trades generally only execute at expiration

- Opportunities may be missed when short-term price action can be captured by limit orders but not by the cash-secured puts or covered calls prior to expiration

- Requires trading at 100-share increments

Best Practices and Tips

- Acquire shares at a discount using cash-secured puts

- Start writing covered calls immediately after acquiring shares

- Use shorter-dated options to maximize time decay

- Use a more aggressive strike (higher delta) on cash-secured puts

- Use a more conservative strike (lower delta) on covered calls

- Avoid writing options into earnings announcements

Summary

Options can be used for many different purposes and portfolios. Any equity investor with stock or ETF holdings should consider utilizing options as a way to generate an income stream to enhance the underlying positions. To maximize the yield of an equity portfolio, both covered calls and cash secured puts should be used together, as this allows the investor to generate an income stream while acquiring and holding the asset. Regardless of the portfolio, following the best practices mentioned above for each strategy and having a consistent, methodological approach will allow you to maximize the effectiveness of each strategy and enhance the yield of your portfolio!

Take advantage of free access to OptionsPlay Canada: www.optionsplay.com/tmx

----------

This article is from Bourse de Montréal Inc. and is being posted with its permission. Opinions expressed in this document do not necessarily represent the views of Bourse de Montréal Inc.

This document is made available for general information purposes only. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

Although care has been taken in the preparation of this document, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information contained in this document and reserve the right to amend or review, at any time and without prior notice, the content of this document.

Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions in this document or of the use of or reliance upon any information appearing in this document.