In fact, you have probably already noticed that once you buy shares, the price will start to fall, and that the reverse is also true: once you sell them, the price starts to rise (as if by magic!). You may have noticed that we are not talking about options yet, we are just talking about the risks associated with the normal activities of the average investor. Since these two risks are already there, you need to ensure that adding options to your portfolio will not add any more risks. Because, depending on the strategies you use, it is clear that options can expose you to new risks, such as time decay, volatility, etc. Such risks are covered in more advanced training on options trading.

Difference between a share and an option

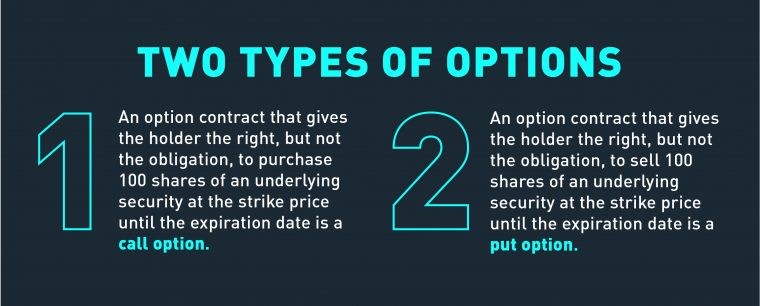

First, a share is a security that gives its holder certain rights (voting rights, transfer rights, dividend rights, a right to the residual value of the company), while a common share option is a contract that generally gives the holder the right, but not the obligation, to buy or sell 100 shares of an underlying security at a predetermined price (the strike or exercise price) for a given period of time (until the expiration date).

When a dividend is paid on shares, the shareholder will receive the amount of the dividend. It is received automatically; no action is required by the shareholder. This is not the case with call options. When you hold call options, you only have the potential to hold the underlying shares. You do not actually hold them until you have exercised your right to buy them. Therefore, in order to receive the dividends paid on a stock, you will need to exercise the call options to become a shareholder before the ex-dividend date.[1]

Trading your first option

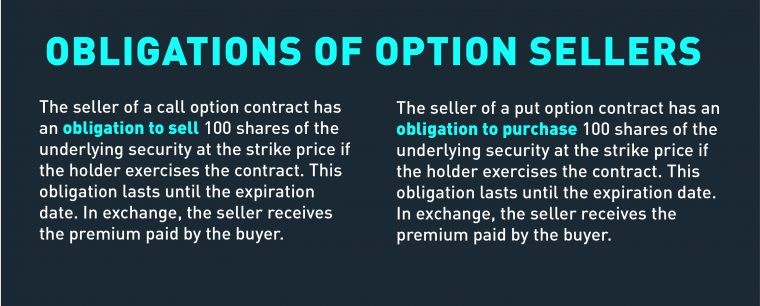

You have been managing your portfolio for some time now, and you would like to incorporate options into your arsenal of investment tools. You are not an expert in options, but you have a method that allows you to determine when to buy shares and when to sell them. In addition, you have just attended an options workshop where you learned that by selling calls, you commit to selling your shares at the chosen strike price until the expiration date, and by selling puts you commit to buying shares at the chosen strike price until the expiration date. So far, so good, since this is exactly what you have been doing in your portfolio for several years now: buying and selling shares.

You want to sell your shares

You hold shares in a stock listed on the Toronto Stock Exchange (TSX) and believe that it has reached, or is about to reach, its full potential to deliver a profit. You would be willing to sell at a price of $32 per share. You could simply offer your shares for sale on the TSX and wait for the market price to reach your target price. However, by selling a call option contract with a strike price of $32, you can kill two birds with one stone. Selling call options commits you to selling your shares at $32, but in exchange for this commitment you receive a premium from the buyer of your options. This is like getting paid to sell your shares. If, at expiration, the stock is trading above $32, then you will sell your shares. Otherwise, you will keep your shares. Either way, you will have received the premium, and this will enhance the return on your portfolio.

I want to buy shares

You have sold shares of a stock and now have the cash to buy shares of another stock listed on the TSX. The stock is currently trading at $38, and you believe that $35 would be a good purchase price. You could simply place an order to buy shares on the TSX and wait for the market price to reach your target price. However, by selling a put option contract with a strike price of $35, you can kill two birds with one stone. Selling put options commits you to buying the shares at $35, but in exchange for this commitment you receive a premium from the buyer of your options. This is like getting paid to buy the shares. If, at expiration, the stock is trading below $35, then you will be forced to buy the shares. Otherwise, you will keep your cash on hand, and you will have collected a premium that will also enhance the return on your portfolio.

Conclusion

In conclusion, you do not need to be an expert to start using the options. You just need to be familiar with the two types of risk inherent in investing: the risk of holding onto shares, and the risk of losing out on an opportunity, once you have sold your shares. Then, it is important to understand that by adopting these two simple strategies (writing call options and writing put options), the worst that can happen is that you either sell your shares or you buy new ones. Moreover, by receiving a premium for the options sold, you end up being paid to either buy or sell shares.

Before you start using the strategies mentioned in this article, we suggest that you test them in the Montréal Exchange’s Trading Simulator.

Good luck with your trading and have a good week!