“Give a man a fish and you will feed him for a day.

Teach a

man to arbitrage and you will feed him forever.” — Warren Buffett

A Primer on M&A Arbitrage

When a company (acquirer) seeks to acquire another company (target), it typically needs to pay a premium over the target’s unaffected share price. This premium is necessary because a target company’s board of directors is only likely to recommend the acquisition of the company if the acquisition price is sufficiently higher than the current share price, otherwise the risk and effort of a deal isn’t worthwhile.

Merger arbitrage is an investment strategy that capitalizes on the spread between a company’s current share price and the consideration paid for its acquisition in the context of an announced merger transaction. The merger arbitrageur seeks to profit from buying a takeover stock at a discount to its acquisition price.

For a typical acquisition, an acquirer offers cash, shares, or a combination of both, to the target’s shareholders. In the case where the merger consideration includes shares, the arbitrageur goes long the target stock while shorting the acquirer’s stock at a ratio equivalent to the share consideration offered. While the share-based merger consideration’s dollar value changes as the acquirer’s share price changes, the arbitrageur “locks in” the spread by shorting the acquirer’s stock to match the consideration offered. Whether the consideration includes cash or shares, the spread is earned once the deal closes successfully.

This spread between the acquisition price and the trading price of a stock exists to compensate the arbitrageur for the risk of the acquisition failing to close. If a deal falls apart, the arbitrageur typically suffers significant losses as the target shares fall precipitously to a price that no longer reflects a takeover premium.

Historical Returns From M&A Arbitrage

Merger arbitrage came to the forefront of hedge fund investment strategies during the takeover boom of the 1980s. At this time when the strategy was still new and lacked substantial competition, returns were high, with some arbitrage firms averaging returns above 20% per annum. Notably, Warren Buffett earned a 53% rate of return from his mergers and acquisitions arbitrage investments in 1988. These high returns were noteworthy because they weren’t dependent on the direction of stock market indices. M&A arbitrage typically generates absolute returns—that is, positive investment returns irrespective of general stock market direction.

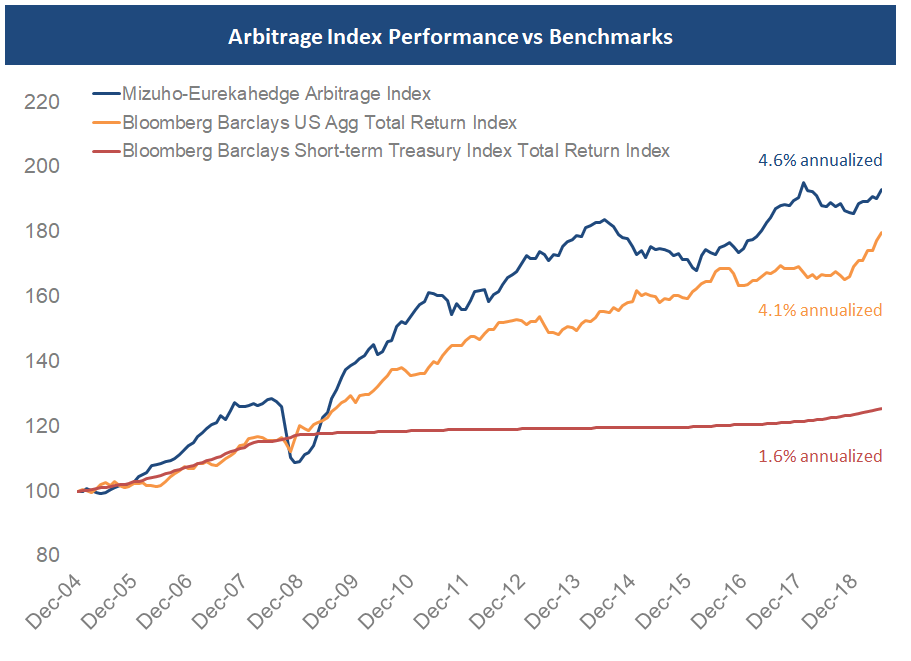

Over the past 15 years, merger arbitrage has been competitive with bonds, with the Eurekahedge Arbitrage Index beating the Bloomberg Barclays Aggregate Bond Index by about 0.5% per year, albeit with higher volatility.

Source: Bloomberg, Eurekahedge

M&A Arbitrage as an Investment Strategy

The market sets the spread of each mergers and acquisitions arbitrage opportunity based on the risk-free rate, typically 3-month treasuries, plus a risk premium. Since 2005, this risk premium has averaged about 3.0%, and with the current risk-free rate around 2.0%, average M&A arbitrage returns are expected to be around 5.0% per year.

While merger arbitrage has historically exhibited a low correlation to both treasuries and the broad-based bond index, it has provided low-volatility returns similar to these fixed income strategies and the returns have been positive most years. Given this characteristic, M&A arbitrage can be thought of as an alternative to fixed income.

However, there are a few main advantages of mergers and acquisitions arbitrage compared to bonds:

- M&A arbitrage returns are driven off a risk spread based on short-term treasuries. Therefore, merger spreads don’t take duration risk given the trades’ short tenor and can be thought of similarly to a floating-rate yield.

- M&A arbitrage returns typically consist of capital gains and therefore are taxed more efficiently than the income produced by bonds.

Feeding Forever off Arbitrage

M&A arbitrage can represent an attractive allocation within a well-diversified investment portfolio given its absolute-return nature, low-risk profile and low correlation to traditional asset classes. However, given the resource and time-intensive nature of the strategy, along with the need to have a well-diversified portfolio of arbitrage investments, individual investors who cannot dedicate themselves full-time to the strategy should steer clear of merger arbitrage and seek to allocate to an arbitrage fund run by a professional.

As Warren Buffett said, “teach a man to arbitrage and you will feed him forever”, meaning arbitrage is an essential investment strategy that aims to generate consistent results in the future. And investors need to eat.

To learn more about Accelerate: https://accelerateshares.com/