Emotions and investing

Investors often make financial decisions—good or bad—based on their emotions. Research in the field of behavioural economics has shown that emotions play a significant role in investing.

Why is this? According to Israeli-American psychologist and economist Daniel Kahneman, people trust their gut more than they should. This is one of the reasons they gamble so much on the stock market—often with poor results. Prospect Theory, developed by Kahneman and Tversky in 1979, holds that the discomfort investors feel when they suffer a loss makes them willing to take bigger risks, believing they have "nothing to lose." The two researchers also found that a financial loss evoked a stronger emotional reaction than winning the exact same amount.

Did you know?

- Market fluctuations are fueled by human emotions and reactions.

- In fact, the world's economy is only held together by consumer confidence.

- If you were to give the same strategy to 10 people, only two of them would come out ahead.

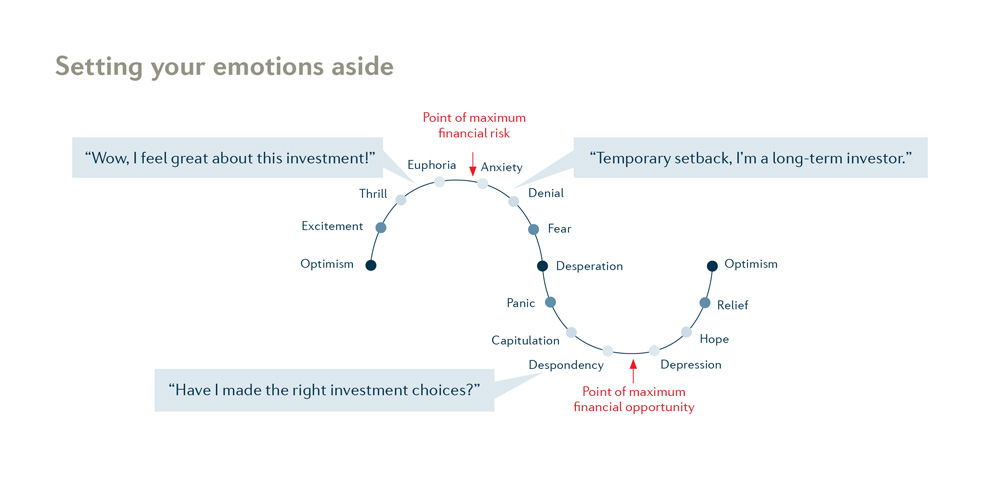

The 4 phases of the emotional cycle

1. Optimism, enthusiasm, thrill and euphoria

There is usually a positive emotion at the root of every decision to buy. When our expectations are met, we feel enthusiastic, thrilled and euphoric. This is the point of maximum financial risk.

2. Anxiety, denial, fear and desperation

Rising markets always end up plateauing, evoking feelings of anxiety, denial and even fear in investors.

3. Panic, capitulation, despondency and depression

When the markets take a nosedive, investors experience despair and panic. Many investors feel depressed and question whether they should keep investing.

During this phase, it's critical to be patient and wait it out.

4. Hope, relief and optimism

When a bull market returns, investors feel relief and new hope. The prospect of a future gains triggers newfound optimism.

Here is an illustration of this emotional cycle:

Now that you've made the decision to manage your assets yourself, it's important to recognize this cycle as it happens. Emotions often cause investors to lose out on great opportunities. When prices drop, investors tend to sell, which goes against the principles of sound investing.

4 golden rules for managing emotions as an investor

- Establish an investment strategy: Do you have a game plan? By setting clear goals and guidelines, you're less likely to make rash decisions.

- Stick to the plan: Be patient. History shows that market dips are often followed by rebounds.

- Invest systematically: Spread out your investments throughout the year so you take advantage of market hikes and avoid heavy losses when markets dip.

- Diversify: By investing in a range of products in various geographical regions, asset categories and sectors of the economy, you'll mitigate the risks associated with any one type of product and increase your return potential.

When you take that first step as a DIY investor, you may

experience the full range of emotions described above. Don't let them

overwhelm you. Be realistic and maintain your perspective. Remind

yourself of your investment objectives at every turn so you don't make

impulsive decisions to buy or sell. With a better understanding of how

these emotions can impact your investing, you'll be able to make

informed decisions, build a solid portfolio and meet your financial goals.