The objective of currency hedging is to remove the effects of foreign exchange movements, giving Canadian investors a return that approximates the return of the local market.

ETF providers offer both hedged and unhedged options giving Canadian investors more tools to efficiently execute their investment strategies. A common institutional approach is to use a blended application, typically 50% hedged, 50% unhedged. Portfolio managers may take an active approach to generate alpha from moves in currency, while others may choose to remain 100% hedged and eliminate currency risks.

Hedging is accomplished by taking a short position in the foreign currency to match the underlying portfolio. If the underlying currency of the foreign investment loses value relative to the Canadian dollar, these losses would be offset by the gain in the currency forward contract. Conversely, if the underlying foreign currency appreciates against the Canadian dollar, these gains would be offset by the losses in the currency forward.

The impacts of currency should not be overlooked

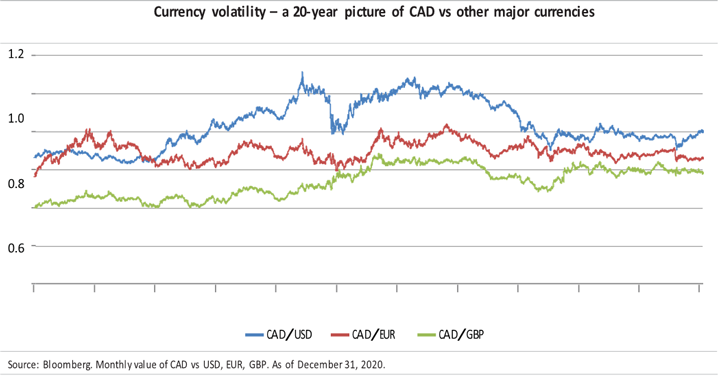

In theory, there is purchasing power parity (PPP) between two currencies, to which they will revert to over time. In practice however, currencies can trade beyond their PPP for extended periods of time, and not all investors are looking to hold an investment over the long-term. Over the short-term, the impact of currency can actually be quite substantial and add volatility. The chart below shows a historical look at the Canadian Dollar versus other major currencies.

The return of the Canadian dollar vs. other major currencies

| U.S. Dollar | Euro | British Pound | Japanese Yen | |

|---|---|---|---|---|

| 2008 | -18.12% | 14.51% | 11.34% | -33.55% |

| 2009 | 15.90% | 13.00% | 4.54% | 18.76% |

| 2010 | 5.41% | 12.89% | 9.28% | -7.96% |

| 2011 | -2.31% | 0.85% | -1.89% | -7.35% |

| 2012 | 2.96% | 1.18% | -1.48% | 16.06% |

| 2013 | -6.60% | -6.60% | -8.37% | 13.39% |

| 2014 | -8.59% | 3.84% | -2.83% | 3.96% |

| 2015 |

-16.01% | -6.43% | -11.22% | -15.71% |

| 2016 | 2.96% | 6.25% | 22.92% | 0.17% |

| 2017 | 6.91% | -6.28% | -2.34% | 3.04% |

| 2018 | -7.83% | -3.50% | -2.40% | -10.31% |

| 2019 | 4.99% | 7.37% | 1.06% | 4.00% |

| 2020 | 2.01% | -6.36% | -1.03% | -2.99% |

| 20 Year Average Return | 1.31 % | -0.09% | 1.68% | 1.13 % |

| 20 Year Standard Deviation | 9.05% | 8.77% | 8.91% | 12.00% |

Source : BMO Asset Managements Inc., Bloomberg

A closer look at the impact of currency on Canadian returns

| S&P 500 Index (Currency Hedged) |

S&P 500 Index Total (Currency Unhedged) |

|

|---|---|---|

| 2004 | 10.88% | 2.81% |

| 2005 | 4.06% | 2.29% |

| 2006 | 14.64% | 15.35% |

| 2007 | 3.79% | -10.53% |

| 2008 | -39.02% | -21.20% |

| 2009 | 24.08% | 7.39% |

| 2010 |

13.55% | 9.06% |

| 2011 | 1.71% | 4.64% |

| 2012 | 16.26% | 13.43% |

| 2013 |

33.33% | 41.27% |

| 2014 |

14.32% | 23.93% |

| 2015 |

0.91% | 21.59% |

| 2016 |

11.40% | 8.09% |

| 2017 |

21.16% | 13.83% |

| 2018 | -5.70% | 4.23% |

| 2019 | 29.87% | 24.84% |

| 2020 | 15.79% | 16.32% |

| 15 Year Average Return | 10.01% | 10.91% |

| 15 Year Standard Deviation | 14.92% | 11.55% |

Source: BMO Asset Management Inc., Morningstar

Currency risk: to hedge or not hedge

The decision can be based on a number of different factors that are specific to the investor.

1. Investor outlook on the currency

As an example, an investor believes the U.S. dollar may appreciate against the Canadian dollar. If this individual is looking to invest in U.S. equities, an unhedged U.S. equity ETF may be more suitable. If the investor’s assumption is correct, he will receive both the returns on the underlying securities and the gains on the currency. On the other hand, if an investor believes the foreign currency will depreciate against the Canadian dollar, a hedged U.S. equity ETF may be the better solution. Given his assumption is correct, the investor will get the returns from the underlying securities, however, the loss of the U.S. dollar relative to the Canadian dollar will be mitigated.

2. Time horizon of the investor

Over shorter periods, it is more likely that currencies can deviate from their equilibrium values as measured by PPP. Given the higher unpredictability over shorter time horizons, hedging currency risk may be a consideration for these investors.

3. Correlation of investments and currency

An understanding of the correlation between investments and its currency may also impact the decision. Some currencies, such as the U.S. dollar, tend to be negatively correlated with equity markets. Consequently, the currency can provide an additional source of diversification for investors. An unhedged position can potentially reduce the volatility of the investors’ portfolio.

On the other hand, an investor may wish to currency hedge their Euro exposure given the currency has tended to move in the same direction as equity markets. For currencies that tend to be positively correlated to equities, the currency can add additional volatility to the portfolio.

Correlation of asset classes and currency

| U.S. Dollar | U.S. Equity | U.S. Fixed Income | |

|---|---|---|---|

| U.S. Dollar | 1.00 | -0.35 | -0.26 |

| U.S. Equity | -0.35 | 1.00 | -0.08 |

| U.S. Fixed Income | -0.26 | -0.08 | 1.00 |

U.S. Equity proxy: S&P 500 Index

U.S. Fixed Income

proxy: Barclays US Aggregate Bond Index

20-year correlation, as

of December 31, 2020

Source: BMO Asset Management Inc., Bloomberg

4. Cost of the underlying hedge

Currencies forwards that are very liquid, such as the U.S. dollar, are less expensive to hedge. On the other hand, for underlying currencies that are less liquid, such as those for emerging markets, hedging foreign exchange exposure becomes more costly and less efficient.

In recent years, ETFs have made accessing U.S. and international markets easier for investors. However, the decision on whether to hedge currency risk tends to be overlooked by many investors. As currency could significantly benefit or disadvantage the total performance of a foreign investment, it should not be taken lightly. The number of hedged and unhedged ETFs allow investors more opportunities to meet their investment objectives.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

®/™Registered trade-marks/trade-mark of Bank of Montreal, used under licence