Market Capitalization Summary

Market capitalization reflects a company’s total value by multiplying its share price by the number of shares outstanding. It helps investors assess risk, growth potential, and compare firms across small, mid, large, and mega cap categories. Diversifying among market caps can balance risk and opportunity while reducing large cap bias, which arises because major indices overweight the biggest companies.

What is Market Capitalization?

Market capitalization, often called market cap, is widely used to gauge a company's size and compare its value to peers. It can help investors see how big or small a company is and assess risk and growth potential, which can’t necessarily be determined by just looking at the share price.

The market cap of a security can be calculated by multiplying the current share price by the number of shares outstanding.

Market capitalization = current share price X number of shares outstanding

Because share prices fluctuate, the market cap changes over time. Most investment platforms will readily provide this information in their quote section.

What are the different Market Capitalizations?

There are over 8000 publicly traded companies on Canadian and U.S. exchanges, with market caps ranging from under $1 million to over $1 trillion. To make sense of these numbers, public companies are commonly classified by market capitalization into 4 different categories: small-cap stocks, mid-cap stocks, large-cap stocks, mega-cap stocks. This classification can be used as a starting point to help investors assess the potential risk, growth, income generation or other criteria, as a suitable investment:

What are small-cap stocks?

Young, smaller companies (typically under $2B). High growth potential and significant upside potential if successful but also carries higher risk and volatility and many companies fail.

What are mid-cap stocks?

Companies in transition ($2B– under $10B). May be continuing a growth phase or nearing maturity in their selected market, offering moderate risk and reward.

What are large-cap stocks?

They are larger firms (over $10B- under $200B), often leaders in their home markets and could have a global presence. They are generally considered lower risk, provide steady income and are in mature industries. Large-cap stocks are sometimes referred as Blue Chips.

What are mega-cap stocks?

Largest publicly traded companies in the world (over $200B). They are industry leaders known for their global reach, strong brand recognition and financial stability.

How investors use Market capitalization?

When searching for investment ideas, investors tend to filter securities by market capitalization depending on their risk tolerance and investment philosophy. Those that have a higher risk tolerance will search for small and mid-cap stocks looking for a future winner. Some of today’s large and mega cap firms started as small cap companies. While others who might prefer more established firms that they believe are less risky and pay dividend might look at large cap stocks.

When analyzing stocks there are several financial metrics that use market capitalization to calculate ratios or to compare different stocks that investors find useful. Many online brokers provide their clients with useful screening tools that can be used to filter stocks.

How to search for stocks based on market capitalization by using Strategy Builder?

Is market cap important?

Yes, market capitalization is important because it helps investors assess a company’s size, risk, and growth potential. Diversifying across different market caps—mega, large, mid, and small—can reduce risk and improve portfolio performance. Market conditions and investor risk appetite influence how each category performs, making market cap a key factor in investment decisions.

Is there a Large-cap bias?

Yes, there is a large-cap bias in the market. Mega and large-cap stocks dominate trading activity and media coverage, while small and mid-cap stocks often receive little attention. Major investment firms focus their analysis on larger companies, making research on smaller firms less accessible to investors.

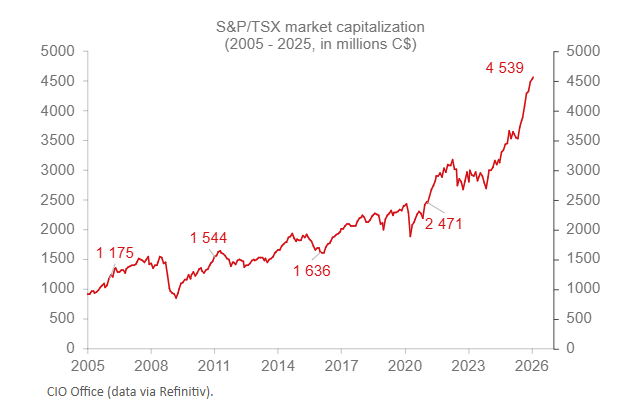

Market indices are typically weighted by market cap, giving larger stocks more influence; for instance, the top 10 holdings account for nearly 40% of the S&P TSX. This concentration can skew benchmarks used by ETFs and mutual funds which results in underweighting small and mid-cap companies.

Impact of large-cap bias

- Reduced diversification: Portfolios and indices heavily weighted toward large-cap stocks may lack exposure to the growth potential and unique opportunities offered by small and mid-cap companies.

- Missed opportunities: Investors may overlook promising smaller firms that could deliver higher returns, especially during periods when large caps underperform.

- Benchmark distortion: Since ETFs and mutual funds often track indices weighted by market cap, their performance may be disproportionately affected by a handful of large companies, increasing concentration risk.

- Limited research and visibility: Small and mid-cap stocks receive less analyst coverage and media attention, making it harder for investors to discover and evaluate these companies.

Being aware of large-cap bias allows investors to take steps to diversify their portfolios and seek opportunities across all market capitalizations, potentially improving long-term returns and managing risk more effectively.

How can an investor correct large-cap bias?

For investors who have a higher risk and volatility tolerance and are growth oriented there are several options available:

- Seeking undervalued small & mid cap stocks can present an opportunity for investors who are willing to do their homework before others catch on.

- Choosing equal-weighted index ETFs, which boost mid and small-cap exposure.

- Adding small and mid-cap index ETFs to their portfolios.

- Opting for actively managed funds (ETFs and mutual funds) focused on small and mid-cap investments.

Balancing Opportunity and Risk: The Importance of Market Cap Diversification

In summary, while large-cap stocks naturally draw the spotlight and shape market indices, investors should be mindful of the risks of overconcentration and missed opportunities in small and mid-cap sectors. By considering equal-weighted or small/mid-cap-focused ETFs, or actively seeking out under-researched companies, investors can diversify their portfolios and potentially enhance returns. Ultimately, a balanced approach that includes both large and smaller companies can help Canadians achieve their investment objectives while managing risk in a dynamic market landscape.

Key Takeaways

- Market cap measures a company’s size (share price × shares outstanding) and helps compare risk and growth potential.

- Firms are categorized as small, mid, large, or mega caps, each with different risk–return profiles.

- Large caps dominate major indices and media coverage, creating a bias that can cause investors to overlook smaller opportunities.

- This bias can be reduced by adding small and mid caps through undervalued stock selection, equal weight ETFs, or specialized funds.