The beneficiary of an RESP is a person for whom the promoter agrees to pay Educational Assistance Payments (EAPs). You can invest a lifetime maximum of $50,000 per beneficiary. To qualify, the beneficiary must:

- Be a Canadian resident

- Have a valid social insurance number

Depending on the type of account you select, the subscriber can be a parent, a grandparent, an aunt or uncle, any member of the family, a friend or whoever wants to save with the intent to contribute to a child’s postsecondary studies. You and your spouse or common-law partner can also be joint subscribers. In this case, each subscriber must provide a valid social insurance number to the promoter, along with that of each beneficiary.

Your RESP contributions are not tax deductible, but the invested capital remains accessible at all times. This capital and the income generated by your investments grow free of taxes until the beneficiary is enrolled in a qualifying educational program.

Federal and provincial grants

The Canadian Education Savings Grant (CESG) is added to the annual amount you contribute to the RESP. The CESG pays 20% of the first $2,500 of your annual contributions, up to $500 per year per beneficiary, or a lifetime limit of $7,200 per beneficiary. It is possible to use unused grant room from previous years, up to 1998, to increase the maximum payment amount to $1,000 per year. Note: grants cannot be paid before the child is born.

Depending on your family situation, an additional CESG of 10% and 20% can be applied to the first $500 contributed in the account. This grant is offered to families with a net income below a certain amount determined by the Canadian government. The additional CESG is included in the lifetime maximum of $7,200 and cannot be carried forward.

Federal grants (CESG and additional CESG) are deposited in your brokerage account at the end of the month following the contribution. For instance, if you contribute to your account on May 3rd, the grant will be deposited in your RESP at the end of the month of June.

The Quebec education savings incentive (QESI) is a tax incentive paid directly to the RESP. You do not have to apply for it. You can receive up to $3,600 per eligible beneficiary.

The QESI is deposited to your account once a year, around May or June of the year following your contributions. For instance, if you contributed to your RESP in 2012, the QESI will be deposited in your account in May or June 2013. Contrary to the CESG, the QESI is calculated on the net RESP contribution amount for the year.

The Alberta Centennial Education Savings (ACES) is a Government of Alberta subsidy of up to $800 per eligible child. Payments can be retroactive to 2005.

If you meet the eligibility criteria, you can also take advantage of

the $500 Canada Learning Bond (CLB), to which the government will add

$100 per year until the beneficiary reaches the age of 15. You could

therefore receive an additional $2,000 for the duration of your

child’s plan.

Types of RESP

When you open an RESP account, you can select an individual or family

plan.

In the case of individual plans, parents, grandparents, aunts, uncles and friends of the family can contribute to a child’s RESP. Conversely, family plans only allow blood relatives (parents, grandparents, sisters and brothers) or adoptive parents to contribute to the RESP.

The choice of your RESP account depends on the number of beneficiaries you wish to include:How do the EAPs work?

Educational Assistance Payments (EAPs) are paid out to the beneficiary in accordance with your instructions. For the first 13 consecutive weeks of enrollment in a full-time studies, the maximum EAP amount is $8,000. For part-time students, this amount is $4,000. After this period, there is no limit on the EAP amount a beneficiary can receive, if the student continues to qualify to receive them.

| Individual RESP |

Family RESP |

|

|---|---|---|

| Beneficiaries |

A single beneficiary regardless of his or her relation to the subscriber |

One or more beneficiaries, who must be related to the subscriber by blood or adoption (children, grand-children, great grand-children or brothers and sisters only). |

| Age limit |

No age limit |

The beneficiaries must be under 21 years of age |

| Breakdown among beneficiaries |

Contributions, withdrawals and Educational Assistance Payments apply to a single beneficiary. |

Contributions are split by the subscriber among the beneficiaries, within each beneficiary's contribution limit. |

| If the child does not pursue post-secondary education |

A new beneficiary may be designated. The grants must be repaid if the new beneficiary is not related to the original beneficiary by blood or adoption. |

The other beneficiaries can split the contributions and grants within their authorized limit. or A new beneficiary may be designated. |

What happens if the child does not pursue postsecondary studies?

If the RESP beneficiary does not pursue postsecondary studies and no other beneficiary is (or can be) designated, grants must be refunded to the governments and the subscriber’s contributions will be returned.

The income generated from the RESP can also be returned to the

subscriber in the form of accumulated income payment to the

subscriber’s RRSP, under certain conditions.

Contributing early

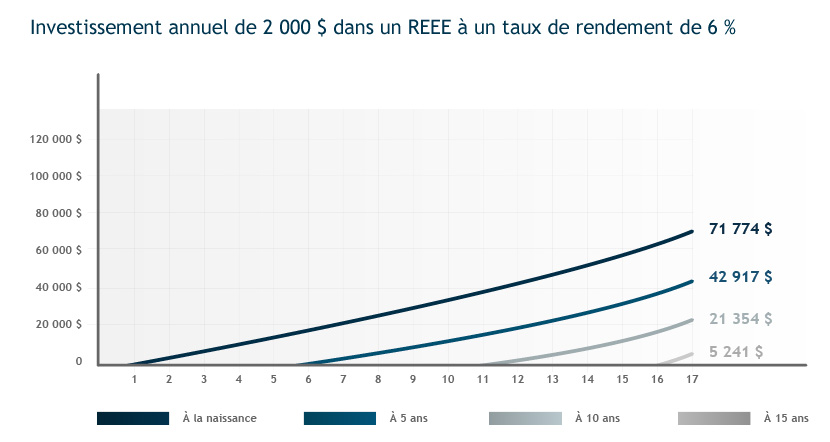

It is important to start saving in the first few years following a child’s birth to take advantage of the government grants and establish a solid investment strategy. Saving as soon as the child is born allows you to take advantage of compound growth over time, as illustrated by the following graph:

In the above example, a child who has been an RESP beneficiary since birth will have more than $70,000 at the time of his or her postsecondary studies. In comparison, the other children will have to consider other sources of financing to be able to cover all of their education-related expenses.

Available investment options and strategies

All RRSP-eligible products can be invested in an RESP. Your investment strategy must however take into account the following factors:

- The beneficiary’s age and the number of years remaining before his or her postsecondary studies

- Your investor profile

In the early stages of the plan, you may want to consider investments with a good long-term growth potential. In subsequent years, you may want to opt for a more conservative strategy in order to protect the accumulated capital as withdrawal time nears.

Finally, in the plan's final years, it may be preferable to focus on capital preservation, all the while generating enough liquidity for the beneficiary's RESP withdrawals.