Enrich your experience as a do-it-yourself investor.

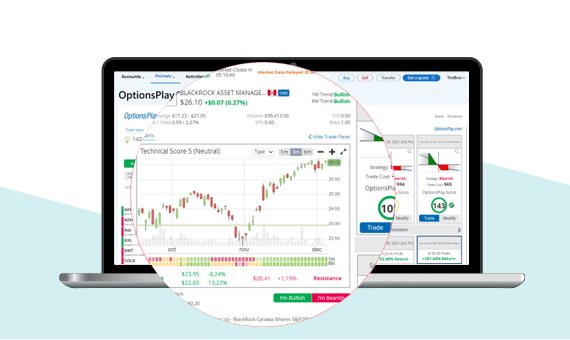

Discover the OptionsPlay® analysis platform to find ideas for options trading. Easily compare 3 strategies that can be used according to your market forecast.*

With OptionsPlay, you can:

- Compare strategies according to your market forecast.

- Understand each strategy’s risk zone.

- Estimate potential gains and losses to make an informed choice.

- Assess the different strategies with the results simulator.

- Access more advanced option strategies.

Welcome to Optionsplay, my name is Tony Zang, I’m the Chief

strategist here at Options Play. Today what I want to give you is

overview of the options play platform

that is available to

National Bank customers, directly integrated into your platform. The

Optionsplay tool is designed from the ground up to try to make your

options trading experience as easy and as simple as possible, removing

a lot of the complexities that you may come across when it comes to

options trading and also guide you through the analysis section of

every single option strategy so that you can compare the risk &

rewards and understand each one of these things before you place an

actual trade.

Now, before I jump into the demo, I just want to remind investors that if you click on the upper right hand corner where you see the guide button, when you click on it, it will bring up a series of flags that if you are on the platform and you're unsure of what a certain term means, you can click on the flag for an explanation. Always reference that to give you a better understanding of the terms that you're seeing on your screen

The platform itself is divided into three sections. On the left-hand side, we have trade ideas and watchlist, in the middle we have our security analysis panel, and on the right-hand side, we have the trading and income panel. I'm going to walk you through each one of these today to give you a better understanding as to how to use this platform from a holistic perspective as well as individual modules, so that you understand the capabilities of this platform to help you to find ideas, analyze the stock or ETF and ultimately find a trading opportunity on that stock or ETF. Depending on whether you have a bullish or bearish view or if you're looking to generate income from your portfolio.

So let’s start off on the left-hand side of the screen, where we have trade ideas and watchlist. Trade ideas can be bullish or bearish and are generated for stocks every single morning based on technical analysis scans, and you can sort and filter based on market cap and even sectors as well as the type of technical analysis scans that generate these types of ideas. Now you can click on any symbol within this trade idea section to populate the rest of the screen and both U.S. and Canadian securities are available with our tool.

You can also create your own watch list by clicking on the watch list section, and you can add U. S and Canadian securities into the tool by typing in a symbol and you'll notice next to the symbol there is a U.S. or Canadian flag. When you click on that symbol, it will then be added to your watch list.

The watchlist feature is designed to give you a summary analysis of the underlying technicals of each underlying security, you'll notice both a score and a color coding across the symbol. The color coding is straightforward green means bullish, yellow means neutral and red means bearish.

Now the technical score shown here as well as in the security panel, is a relative strength indicator to give you a better sense as to whether a stock is outperforming the broader markets or underperforming the broader markets, the score ranges from 1 to 10. 10 are the stocks that are outperforming the market by the greatest amount. Ones are the ones that are underperforming the markets by the greatest amount.

You can also filter by score and when you see the OptionsPlay logo appear that means that multiple technical analysis points occurred on that symbol.

Let’s move on to the security analysis section. As mentioned before you can click on any symbol from the ideas section or watchlist or even type in a symbol you hold or are thinking about in the quote section and the info will appear in the middle of the panel which we call our security analysis panel. This is designed to make your security analysis as easy as simple as possible by providing summary technical analysis indicators such as one month and six months trend, which we use moving averages to determine the short- and long-term trend of each underlying stock.

So when we look at a stock like apple that has one month and six months trends that are bullish and currently outperforming the broader markets, those are generally considered bullish candidates on a trader's mindset. On the panel you will also have important information like earnings, dividends and price action data here at the bottom of your screen. Once you take a view on an underlying stock, you can either select I'm bullish and populate three bullish strategies here on the left hand side of your screen. Or select I'm bearish to populate three bearish strategies here on your screen. Now the tool is designed from the ground up to allow anyone, even if your brand new options trading to be able to start exploring and analyzing option strategies and comparing them to strategies that perhaps you are more familiar with, such as buying 100 shares of a stock. So in this particular case, if I'm looking at Apple and I can choose strategy one which is buying 100 shares of the stock, it would cost me roughly $13,700. If we compare it to strategy 2 which is a simple option strategy, buying a call option, which cost $$865. Or, for those who are a little more experienced in trading options we have a vertical spread, which only cost me $592.

For your info a vertical spread involves buying a call option at a lower strike price in our case 136$ and then selling a call option at a higher strike price. By selling the call option at a higher price I receive premium which helps lower the overall cost of buying the call option at a lower strike price, that’s why this strategy costs less. By getting this extra income I forgo any potential profits if the shares of apple increase past $155 in our case.

Now this particular tool, not only does it select the strategies for you, it also selects the expiration dates and strike prices based on OptionsPlay best practices in terms of finding optimal expiration dates and strike prices. In other words you already have strategies that are optimized and that are ready to go that you can utilize for trading immediately.

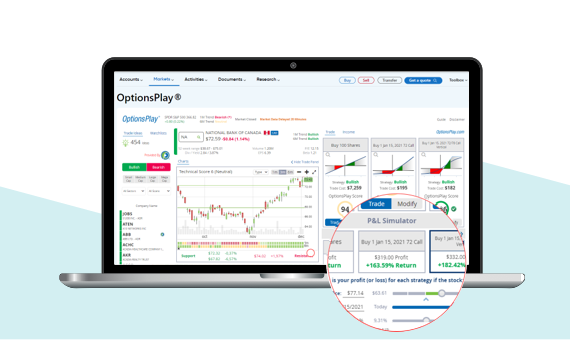

Now, one of the most powerful tools that we provide for investors of all experience levels is our P\L simulator. This allows you to simulate the potential outlook of the underlying stock in the future and seeing how these strategies perform next to each other.

So with Apple stock currently trading at $136. If I think that Apple stock perhaps might rally back up to the 157 resistance level that I have identified here, then I can plug that into my my PML simulator and see exactly what my expected return and profit for each strategy will look like. This tool can also be used to determine what is your potential for loss? How much do you have at risk if this trade does not go in your favor? This is really where options can really play to your advantage by helping you limit your losses if the trade doesn't go in the direction that you expected to.

As an example let’s say we have an unexpeceted market pull back and Apple stock declines back down to its lower support here around 120 then you can plug that into those levels and see what the result would be for the 3 strategies.

As we can see, I'm risking almost $1800 on the stock both of my option strategies result in a 100% loss but in dollar terms my loss for the call option is about $900 and only $685 on the vertical spread, meaning that the strategy on the right hand side gives me a relatively small amount of risk for the three strategies and potentially a, higher return if the stock does go in my favour. So that's why the strategy here on the right has the highest optionsPlay score.

Now, most platforms will give you a breakdown of the strategy based on max reward, max risk, probability of profit, as well as your breakeven price on each one of these strategies. But most investors will find that if they just simply look at a page that looks like this, it's difficult to compare these numbers and determine which strategy actually provides the best risk reward ratio. And that's why we created the optionsplay score to make this as easy as possible. And it's color coded so that you can easily identify which strategies have relatively poor risk reward, like this call option here and which ones have relatively strong risk reward. Like the strategy here on the right. In general for option strategies you should be looking for a score of 100 or more.

Now these are optimal starting points but many investors may want to make adjustments, you can always click on the modified button to change the expiration dates by clicking here or change the strike prices either moving up or down as well as changing the strategy altogether using the strategy constructor. Another feature is changing the bid\ask prices and using the mid price when the bid\ask spread is large. All this is available at your fingertips using the edit legs or modifies function.

The tool is called OptionsPlay because you have the ability to easily explore different strategies. Different expiration dates, different strike prices and always return back to the P&L simulator to simulate exactly what you're expected profit potential would be or loss in all different types of scenarios.

There are also a few other tools here that are designed for beginners to help you better understand each strategy. Sometimes beginners may have trouble understanding what a vertical call spread actually means. So we have a plain English section that helps you better understand each strategy.

We have a risk and investment calculator to allow investors to easily calculate the appropriate number of contracts that you might want to trade for a certain amount of capital that you're willing to risk.

For the more advanced traders have access to what's called a training range simulator. The training range similar is designed to give you a sense for what is the expected from a one standard deviation move for any expected expiration date and you can always make adjustments to your expected trading range and see the risk & reward metrics being calculated based on your expected trading range.

Now once you've determined what strategy that you would like to trade, you can click on the trade button to trigger our strategy checklist and our trade ticket. This is designed to give you a better understanding as to how to enter this order into your platform so that you have all the relevant information shown here.

We also have a strategy checklist. This strategy checklist is designed to quickly allow you to determine some of the typical risks and rewards that are important to understand before you place a trade, whether you're trading with the trend of the stock, the trend of the market, the optionsplay score which gauges risk reward metrics, the next earning date to see if there's earnings between now and the expiration date of these strategy and lastly, spread and liquidity, something that is important to understand for options investors.

Now we tend to find that most investors, when it comes to options, fits into two different buckets. You have speculators or investors who are looking to take advantage of a bullish or bearish move in an underlying stock and want to potentially profit from that directional view.

That's what the trading tab that we just reviewed is for, but for many investors, options is a tool that allows you to generate income from stocks that you might own in your portfolio or are considering owning and that's where we turn to the income tool.

Now, before I walk you through the income tool, I want you to know that there is an income settings button here at the bottom. It's important for investors who are starting out to first set their settings before looking at any strategies.

You can set your setting separately for covered calls or cash secured puts. Covered calls is a great strategy for investors who already own a stock or ETF, and are looking to add additional yield to that position and cash secured puts are ideal for stocks that you want to acquire, meaning stocks that you want to purchase. Cash secured puts potentially allow you to purchase the stock at a discount while capturing some yield while you attempt to purchase the stock at a specific price.

So you can set both your covered call timeframe short term, medium

or long term in terms of expiration dates. Also conservative, optimal

or aggressive in terms of your risk tolerance for both covered calls

and cash secured puts independently, So I have my setting set to short

term optimal for covered calls and short term

aggressive for

cash secured puts. You can set your own settings and click on Save as

Default. And once you do that, you can click on any symbol of a stock

that you either own or stock that you want to own and OptionsPlay will

do the same thing as the trading tab by displaying to you an optimal

expiration date and strike price as a starting point.

So if in this particular example, if let's say you currently own Apple stock in your portfolio, click on the yes button at the top and the tool will ask you, Do you own shares of Apple? If you say yes, Optionsplay will suggest a covered call strategy with an expiration date and strike price based on your personalized settings, and what this will provide you with, are not only the income levels that you should expect to collect but also the annualized return and yield that you would collect on this particular stock.

So Apple currently pays about a 0.60% dividend yield, but the all yield on the February 12 152.5 covered call generates an additional 19.91% yield, which brings your total 12 month projected yield to 20.52%. And this is designed to give you a much better understanding as to not only your starting points, but how much yield are you actually collecting on a covered call position like this? Also one part worth noting is the letters POW which stands for probability of expiring worthless. Most investors that write covered calls are looking for income and not necessarily to sell their shares. Any probability over 80% is considered good by Optionsplay.

We also have a plain English tab here at the bottom for investors who are new to this strategy and want to learn more, and for investors who are ready to pull the trigger, you can click on the trade button. We will show you how to enter this trade directly into your platform again with a bid and ask quote, and also with the strategy checklist to make sure that you understand your risk before you place that trade. By clicking on the trade button an order ticket will appear with the information already provided, all you need to do is specify if you want a market or limit order and the price.

For investors who are looking to acquire a specific stock, a,

overlooked strategy by many investors is a cash secured put, which

allow you to accumulate some yield

while attempting to buy the

stock at a specific price. In this particular case, selling the

February 12, 130 puts obligates me to buy the stock at $130 if the

stock is below $130 on February 12th. But for that obligation, I am

going to be paid $300 by selling the put option, which is a raw return

of about 2.2%. That means if Apple is below $130 on February 12th, I'm

gonna be able to buy the stock at $130 for 100 shares of it, minus the

$300 that I collected. So I'm collecting about a 2.2% discount on the

stock purchase of Facebook stock, and it provides an annual eyes yield

of about 36%. So if Apple stock is above $130 an expiration. I keep

the $300 and I can choose to sell another put as well and continue to

generate income on my portfolio.

And lastly, once I'm ready to place that trade, I can click on the trade button, see the details for how to enter these trades on the platform and used the strategy checklist to make sure that I understand all of my risk before I place my trade. So this provides everyone with a quick overview of the trading platform.

As you can see, the platform again is designed from the ground up to

try to make the options trading experience as simple and as visual and

as intuitive as

possible, to try to remove some of the

complexities that comes with options trading and guide you through the

process. Step by step, everything from idea generation and for those

of you that are stock investors, you can still use the trade ideas to

find stock, in stock investment ideas. You don't necessarily have to

trade the option. You can use our trade ideas to find fresh, bullish

and bearish ideas. Every day, the security analysis panel will help

you quickly type in any symbol and and instantly gauge the directional

view of that stock based on the one month, 6 month and six months

trend and the technical score. And lastly, once you have that

directional view, taking advantage of that directional view using

options or the stock through the trading tab to allow you to compare

any three strategies side by side, using the P\L simulator to see what

your potential risks are and your potential rewards if you are

correct, as well as income strategies.

For many investors who currently own stocks or ETFs in your portfolio, add some additional yield to your portfolio with that.

I want to thank everyone for taking the time to watch this video. I hope that this was helpful in giving you a better understanding of the options platform. We are very excited to have created this new partnership with National Bank who is the first Canadian broker to integrate our platform directly into their trading platform. Thank you so much, and I hope you have a great trading day

- Technical Concept

- Strategy Comparison Tool

- Results Simulator

Technical Concept

Get an unbiased analysis of several stocks along with technical buy and sell signals.

Strategy Comparison Tool

Easily compare three possible trading strategies, including two on options and one on stocks. The OptionsPlay rating system helps you understand the risk/return ratio’s assessment.

Results Simulator

View the estimated gains and losses quickly as well as the potential returns of the various strategies suggested. Each strategy is explained in detail to make an enlightened decision.

The fine print

*Not available on the mobile version

We're here for you

Questions? All answers, no hassle

Ready to open an account?

Take advantage of $0 commission on all online stock and ETF transactions

Open an account